All Categories

Featured

Table of Contents

Another opportunity is if the deceased had a current life insurance policy. In such instances, the designated recipient may receive the life insurance policy earnings and make use of all or a part of it to pay off the home loan, permitting them to remain in the home. do you need to have mortgage insurance. For individuals that have a reverse mortgage, which allows people aged 55 and above to acquire a home loan based upon their home equity, the loan passion builds up over time

Throughout the residency in the home, no settlements are required. It is essential for individuals to very carefully plan and consider these elements when it comes to mortgages in Canada and their influence on the estate and beneficiaries. Seeking advice from legal and economic experts can aid ensure a smooth shift and appropriate handling of the home mortgage after the homeowner's death.

It is essential to comprehend the offered options to guarantee the mortgage is appropriately taken care of. After the fatality of a property owner, there are a number of choices for home mortgage settlement that depend on numerous variables, including the terms of the home mortgage, the deceased's estate planning, and the dreams of the successors. Right here are some typical options:: If several successors desire to think the home loan, they can become co-borrowers and continue making the home mortgage settlements.

This choice can supply a clean resolution to the mortgage and disperse the remaining funds among the heirs.: If the deceased had a present life insurance policy, the designated beneficiary might get the life insurance coverage earnings and utilize them to pay off the mortgage (why pay mortgage insurance). This can allow the recipient to continue to be in the home without the problem of the mortgage

If no one remains to make home loan payments after the property owner's fatality, the home loan creditor deserves to confiscate on the home. Nonetheless, the influence of repossession can vary depending upon the situation. If a beneficiary is called however does not sell your house or make the home loan settlements, the home mortgage servicer might launch a transfer of possession, and the foreclosure might severely damage the non-paying successor's credit.In cases where a homeowner dies without a will or trust, the courts will appoint an executor of the estate, typically a close living relative, to disperse the assets and responsibilities.

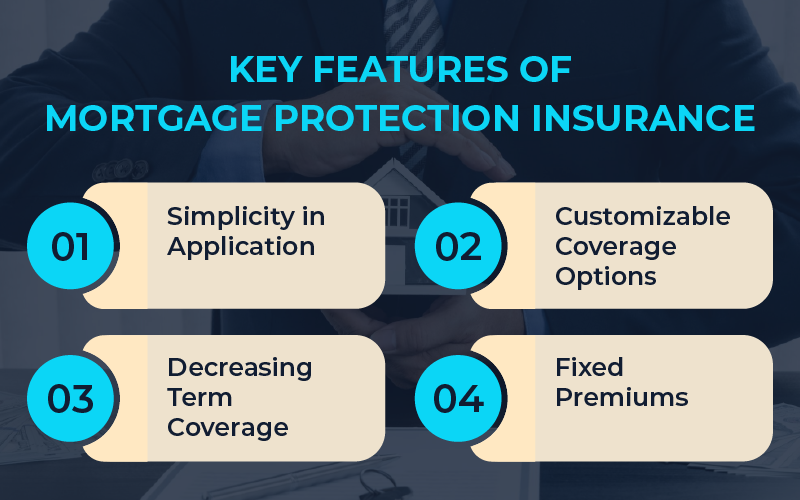

Mortgage Protection Insurance

Mortgage defense insurance policy (MPI) is a type of life insurance policy that is specifically developed for people that intend to ensure their home mortgage is paid if they pass away or come to be impaired. Occasionally this sort of plan is called mortgage payment protection insurance policy. The MPI procedure is basic. When you pass away, the insurance proceeds are paid straight to your home loan company.

When a financial institution possesses the huge bulk of your home, they are responsible if something occurs to you and you can no longer pay. PMI covers their threat in the occasion of a repossession on your home (mortgage payment protection insurance uk). On the various other hand, MPI covers your threat in case you can no longer pay on your home

MPI is the type of home loan security insurance coverage every home owner ought to have in position for their household. The amount of MPI you require will differ relying on your unique scenario. Some elements you need to consider when taking into consideration MPI are: Your age Your health Your economic circumstance and resources Other kinds of insurance policy that you have Some people might think that if they presently possess $200,000 on their home loan that they should get a $200,000 MPI policy.

Mpi Mortgage Insurance

The short solution isit depends. The inquiries individuals have concerning whether or not MPI is worth it or otherwise are the same concerns they have concerning acquiring other kinds of insurance as a whole. For the majority of people, a home is our solitary largest financial debt. That suggests it's mosting likely to be the solitary biggest monetary difficulty encountering enduring family participants when an income producer passes away.

The combination of anxiety, sorrow and transforming household characteristics can cause also the most effective intentioned individuals to make pricey mistakes. home death insurance. MPI fixes that problem. The worth of the MPI policy is straight connected to the equilibrium of your home loan, and insurance policy earnings are paid straight to the financial institution to deal with the staying equilibrium

And the largest and most stressful economic issue encountering the surviving family members is settled instantaneously. If you have health issues that have or will produce problems for you being accepted for regular life insurance policy, such as term or entire life, MPI might be an exceptional choice for you. Typically, home mortgage defense insurance plan do not need medical examinations.

Historically, the quantity of insurance protection on MPI plans went down as the balance on a home mortgage was minimized. Today, the coverage on a lot of MPI policies will certainly stay at the very same degree you bought originally. If your original home loan was $150,000 and you bought $150,000 of home mortgage security life insurance, your beneficiaries will now receive $150,000 no matter exactly how a lot you owe on your home loan.

If you want to repay your mortgage early, some insurance provider will certainly permit you to convert your MPI plan to another type of life insurance policy. This is among the inquiries you might intend to address up front if you are considering settling your home early. Costs for home loan security insurance will differ based on a variety of things.

What Is Mortgage Term Assurance

An additional factor that will certainly influence the costs quantity is if you get an MPI plan that supplies coverage for both you and your spouse, giving benefits when either one of you passes away or becomes disabled. Be conscious that some firms may need your plan to be reissued if you refinance your home, however that's normally just the case if you acquired a plan that pays just the balance left on your mortgage.

As such, what it covers is very narrow and plainly specified, depending on the options you select for your particular policy. Obvious. If you pass away, your home loan is paid off. With today's plans, the value might exceed what is owed, so you can see an extra payment that could be made use of for any kind of unspecified usage.

For home loan defense insurance policy, these forms of additional insurance coverage are added to plans and are called living advantage riders. They enable policy holders to tap right into their home loan defense benefits without diing. Right here's just how living benefit bikers can make a home mortgage protection policy better. In instances of, the majority of insurance policy companies have this as a free advantage.

For instances of, this is usually currently a totally free living benefit offered by the majority of companies, yet each firm specifies benefit payments in a different way. This covers diseases such as cancer, kidney failure, cardiac arrest, strokes, mind damage and others. mortgage protection definition. Business usually pay in a round figure depending on the insured's age and extent of the illness

Unlike many life insurance coverage policies, getting MPI does not require a clinical examination a lot of the time. This indicates if you can not obtain term life insurance coverage due to an ailment, an assured problem mortgage protection insurance policy can be your ideal bet.

No matter of that you determine to check out a policy with, you need to constantly shop about, because you do have options. If you do not qualify for term life insurance coverage, then accidental death insurance may make more feeling because it's warranty concern and means you will certainly not be subject to clinical examinations or underwriting.

Protection That Pays

Make sure it covers all expenditures associated with your home loan, including interest and repayments. Consider these elements when choosing precisely how much insurance coverage you think you will certainly need. Ask exactly how rapidly the plan will certainly be paid out if and when the major earnings earner dies. Your household will be under sufficient psychological tension without needing to wonder how much time it might be before you see a payout.

Latest Posts

Funeral Expense Plans

Final Expense Life Insurance Jobs

Burial Insurance State Farm